The Currently Not Collectible (CNC) program is an IRS program designed to provide relief from collection activities for taxpayers who would encounter undue financial hardship if they had to pay their tax debt. The IRS requires you to provide information…

Read More

The recent tax law changes eliminated the deduction for personal casualty losses for tax years 2018 through 2025, but did retain a deduction for losses within a federally declared disaster area. As a result of the wild fires in the…

Read More

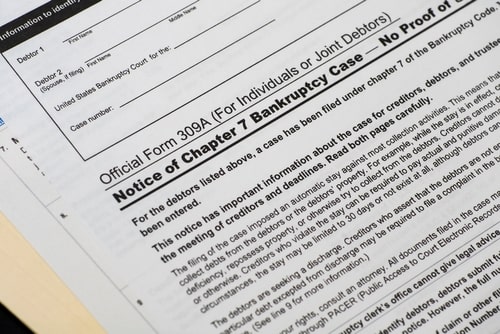

For many individuals struggling with overwhelming debt, bankruptcy can be an attractive option that allows the individual to start over with a “blank slate,” as it were. However, not all debts can be discharged through bankruptcy, and some are easier…

Read More

IRS audits have been on the decline in recent years as a result of the reduction in IRS enforcement personnel. According to the IRS’s 2017 Data Book, the IRS audited just over 900,000 individual tax returns, or about 0.6%, of all tax returns…

Read More

You’ve filed your tax return with a balance due and are unable to pay and are unsure what you should do next. Well, within a short period of time after receiving your return, the IRS will begin its automated collection…

Read More

The IRS’s offer in compromise program can be a great way to reduce the amount of debt you owe and make your payments more manageable. After all, the program is mutually beneficial to you and the IRS—it allows you to negotiate…

Read More

Have you realized gain from the sale of an asset and want to defer paying the tax? Opportunity Zone Investments may be the solution for you. If you have a large taxable gain from the sale of a stock, asset, or business and who…

Read More

If you are a business owner who is accustomed to treating clients to sporting events, golf getaways, concerts and the like, you were no doubt disappointed by the part of the tax reform that passed last year that did away with the…

Read More

There are many reasons why taxpayers find themselves with tax problems and on rare occasions it is due to criminal intent. However, the majority of tax problem resolution cases we deal with are caused by some serious event that occurred in the taxpayer’s life. (more…)

Read More

We know the story all too well: finances are tight so you either don't file your tax return or file the return but don’t pay the balance due. But you tell yourself not to worry as next year things will…

Read More